Sukuk are capital market instruments in the same way as stocks and bonds. Sukuk are tradable securities and can be listed on major stock exchanges around the world and settled through international securities clearing systems.

Brun Lubert supports a wide spectrum of listed and non-listed sukuk issues, an Islamic bond or financial certificate with similar characteristics as a conventional bond. Sukuk can be structured to offer a fixed return, similar to the interest on a conventional bond, with the difference that it is structured in a Sharia compliant manner, and represents undivided proportionate ownership in the eligible underlying asset or investment. Whereas bond investors receive periodic interest payments (debt obligations), sukuk investors receive profit generated by the underlying asset on a periodic basis (asset ownership).

We collaborate with a premium network of brokers, bookrunners, banks, and law firms across the leading sukuk markets in the US, Europe, and Asia, to ensure effective sukuk issues.

Sukuk are structured as a trust certificate, by creating an offshore SPV, either asset-backed or non-asset backed, which issues the trust certificates to qualifing investors and fowards the proceeds under the terms of a funding agreement with the issuing entity. In return, the investors earn a portion of the profit linked to the asset. If the SPV and trust certificate cannot be created, a sukuk is structured as an alternative civil law structure, such as an asset-leasing company.

“Sukuk supported by Brun Lubert include ljarah sukuk, musharakah sukuk, and istisna sukuk.”

From advisory to acting as anchor investor, we assist corporates and other issuers to navigate a complex sukuk life cycle, and to support a quick and cost-efficient sukuk issue.

Global Sukuk Markets

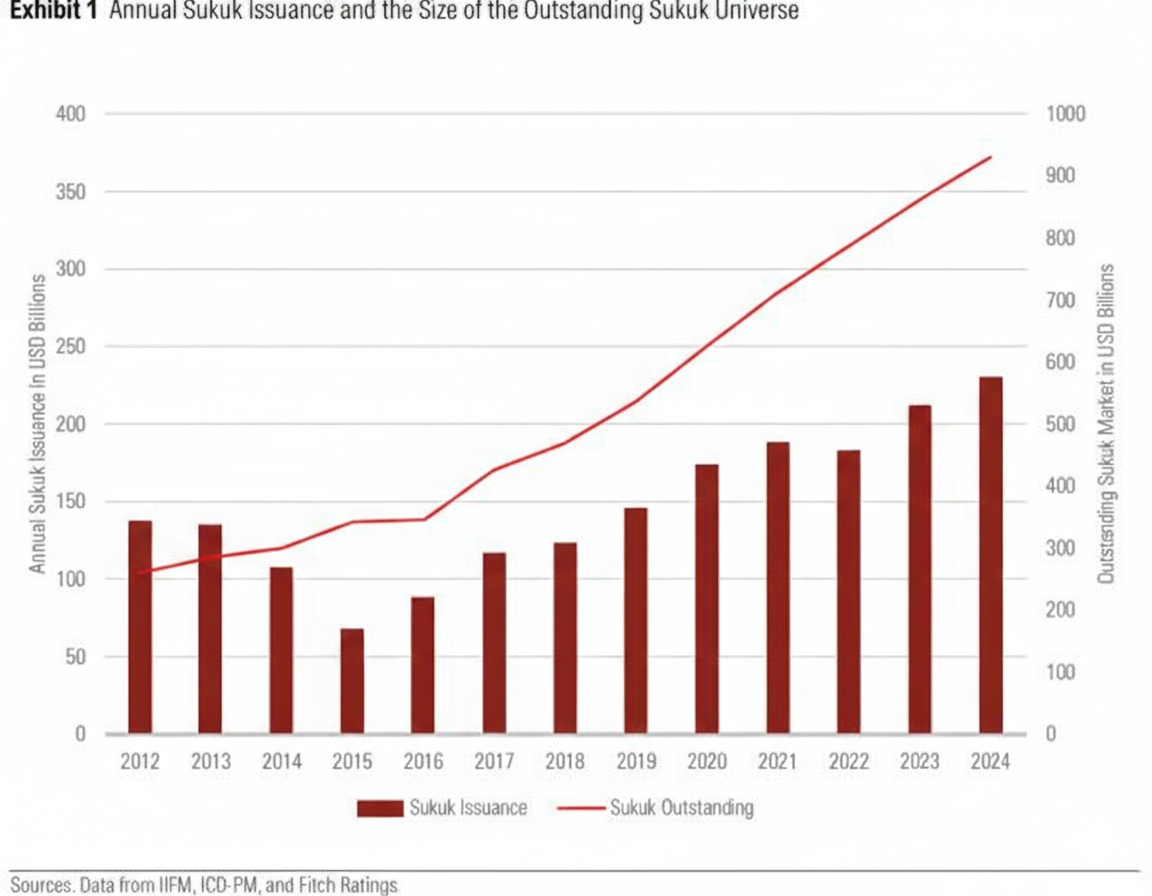

Sukuk issuers have flocked to the markets in record numbers in the past decade. The global sukuk market has enjoyed tremendous growth since 2013 with 80 to 90 per cent of Fitch-rated sukuk being investment-grade and without default. Total Fitch-rated sukuk exceeded USD 210bn in 2025.

As highlighted in the Dow Jones Sukuk Total Return Index and the S&P Global High Yield Sukuk Index, US denominated sukuk markets have shown a compound annualized growth rate of approx 20 per cent, driven by increased issues by sovereigns and supranationals, as well as strong investor demand for Sharia-compliant securities from markets across the world.

“The London Stock Exchange remains a key global venue for sukuk listings.”

The growth of the global sukuk market will accelerate, as issuers seek to refinance matured bonds and new entrants continue to come to market, including issuers from African countries. Key Islamic capital markets continue to enhance the issuance standards and structures and to strengthen regulatory requirements. Risk-adjustment and the strong credit fundamentals of most sukuk issuers attract investors in the US, Europe, and Asia, which increasingly see sukuk as an effective way to invest in some of the fastest growing emerging economies.

The London Stock Exchange remains a key venue for global sukuk listings, with over USD 50bn raised through 68 issues of sukuk issues on the LSE International Securities Market and Main Market.