Fixed-income markets are the lifeblood of the global economy. Access to credit plays a major role in the evolvement of national economies and corporates. It supports innovation for economic and social advancement.

Today’s fixed-income markets move at a rapid pace, assisted by technology, increased market visibility, and more efficient listing processes, providing access to robust debt capital markets.

“We know when to move with the crowds, and when to move against it.”

Markets are dynamic. Brun Lubert follows a disciplined debt structuring and investment process that combines top-down country allocation with bottom-up credit analysis to identify undervalued debt securities. We aim to take advantage of divergent debt cycles, performance variations between regions, and of geopolitical events that create pricing dislocations. Our analysts have a comprehensive view of the markets. We know when to move with the crowds, and when to move against it.

Modern fixed-income markets make lending available in many forms, such as bonds and loans, and through a variety of lenders, from traditional banks to private market lenders. These lenders come with different approaches and terms. At times the markets may look complex, if not opaque, in particular for first-time entrants. We believe that with increased electronic trading, including for corporate bonds (with USD 50bn corporate bonds traded daily in 2025 in the US alone), the lack of transparency and the frequency of bilateral trading will decrease.

“Non-bank lenders play an increasingly larger role in global credit markets.”

With slowed-down bank and leveraged loan growth, non-bank lenders play an increasingly larger role in global credit markets, and have taken over a large part of the role of traditional commercial lenders, in particular in the US. Private debt markets, part of the alternative asset class, have matured and stood at USD 2 trillion at the start of 2025.

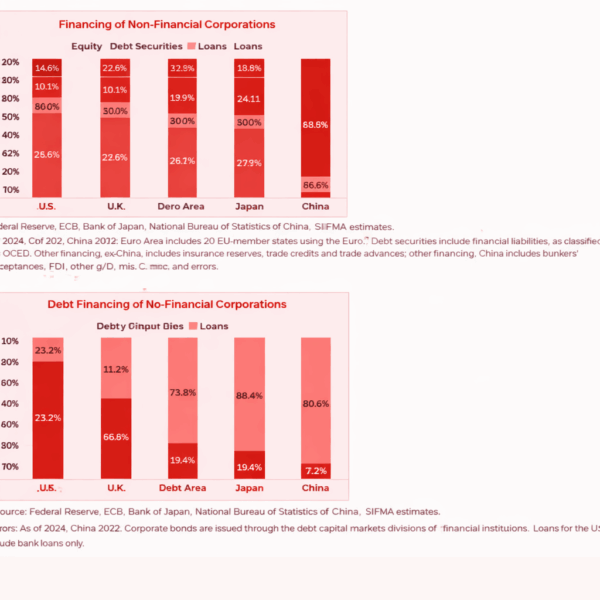

The private debt market is expected to grow to USD 2.3 trillion by 2027, and has gained more pricing power as public markets and banks continue to tighten their credit offerings. A telling example is the fact that private market loans provided over 70 per cent of debt to the leveraged buy-out (LBO) middle market, and 46 per cent to larger transactions (USD 1bn+) in the United States in 2025, non-financial businesses owed 77 per cent of their debt obligations to bond issuance and only 23 percent to bank loans (the opposite is the case in the UK, Japan, and Eurozone).*

Debt Financing of Non-Financial Corporations