Yet corporate bond markets remain largely underdeveloped in emerging economies, in particular in African markets. In relative terms, emerging markets investment-grade corporate bonds equal about 25% of the US and 15% of the global investment-grade corporate bond markets. Emerging markets corporate issuers represent only 2% and 5% of the US corporate and global corporate bond indices.

“Corporate bond markets remain underdeveloped in emerging economies, in particular in African markets.”

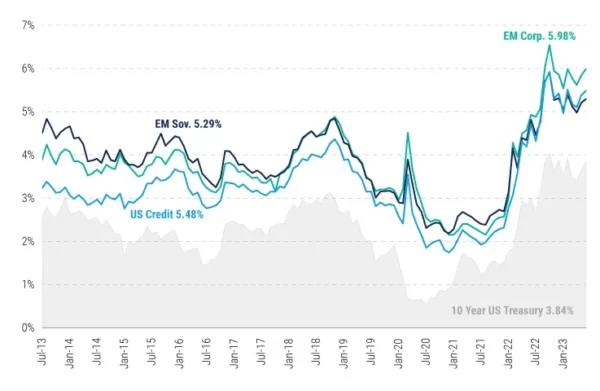

In the first 6 months of 2025, emerging markets investment grade corporate bonds returned 8.73%, emerging markets investment grade sovereigns returned 10.16%, and US investment grade corporates returned 7.7% Bloomberg BBG US Investment Grade Corporate Bond Index). The strong performance was also clear when comparing credit spreads across other markets. The positive returns for emerging markets investment grade corporate bonds weathered substantial increases in nominal US Treasury yields for the same period, demonstrating the resilience of the asset class.

Many investors consider the higher yield offered by emerging markets investment grade corporate debt as compensation for a more volatile asset class than similarly rated US corporate bonds. This is historically untrue. Over the past decade emerging markets investment grade corporate bonds have delivered higher returns with less volatility compared to US investment grade corporate bonds. Compared with emerging markets investment grade sovereign bonds, traditionally the fixed-income against which external investors benchmark their exposure, emerging markets corporates have outperformed the latter in risk adjusted terms, which in part can be explained by the fact that investment grade corporate net leverage is much lower than in the US and Europe, and the average quality of credit fundamentals can be rated as good.

Philosophy

The performance of the emerging markets investment grade corporate debt asset class comes as a surprise to many investors. With an average rating of BBB-, the credit quality of many emerging markets corporates is better than their sovereign counterparts and shows lower volatility. With the multitude of economically growing emerging countries, industries, and issuers in different stages of the economic cycle, there are increasingly more opportunities available, providing a combination of favorable yield and income. Emerging markets investment grade corporate bonds provide portfolio diversification, as their returns are not closely related to traditional asset classes, with many investors seeking to offset the currency risk in their portfolios by investing in emerging markets bonds in local currencies.

The performance, inefficiencies, and underdevelopment of the emerging markets corporate bond space, make that these markets can offer premium returns for investors. Brun Lubert Global Debt Securities pairs market inefficiencies with event-driven opportunities, including temporary mispricing, debt maturities, regulatory market changes, currency exchange volatility, or external geopolitical shock events.